Car Financing Online That Gives You Control, Speed, and Financial Clarity

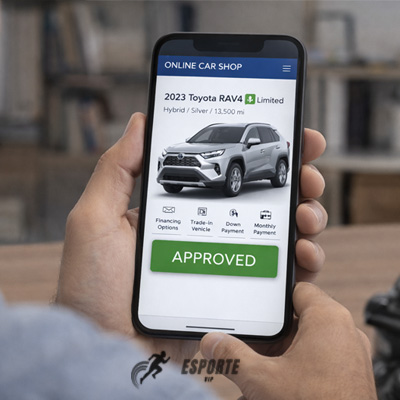

Buying a vehicle in the United States increasingly depends on how well consumers understand car financing online tools.

While car prices and interest rates remain elevated, online financing has become a practical solution for informed buyers.

By separating the loan decision from the dealership environment, consumers gain transparency, predictability, and time to evaluate long-term financial impact.

See how the Nissan Rogue 2025 performs in daily driving, comfort, safety, and long-term value before making a decision.

Learn How Car Financing Online Actually Works From Application to Approval 💻

Digital auto financing begins with an online application submitted to a bank, credit union, or specialized lending platform.

Instead of negotiating financing inside a dealership, applicants provide financial data remotely and receive structured loan offers.

Most systems analyze income stability, credit behavior, and requested loan amount to generate conditional approvals.

Because car financing online removes sales pressure, applicants can review terms calmly and compare offers without time constraints or emotional decisions tied to the vehicle itself.

Why Financial Transparency Improves With Car Financing Online

Traditional dealership financing often combines vehicle pricing, warranties, add-ons, and interest into a single conversation.

This structure makes it harder to isolate the true cost of borrowing.

Online financing separates these elements. Borrowers see loan conditions independently, including APR, total interest paid, and payment schedules.

This clarity helps buyers identify unrealistic offers before committing.

When using car financing online, the borrower evaluates financing as a financial product, not a sales incentive, which reduces long-term regret and payment strain.

Who Benefits Most From Car Financing Online in the U.S. Market 📊

Digital auto financing adapts well to different financial profiles and ownership goals.

Some buyers prioritize approval speed, while others focus on minimizing interest or maintaining predictable monthly obligations.

Online platforms support both objectives by offering adjustable terms, lender comparisons, and simulation tools.

This flexibility benefits individuals managing tight budgets as well as those optimizing long-term financial planning.

Because car financing online is scalable and data-driven, it aligns better with real household finances than one-size-fits-all dealership offers.

Understand Rates, Terms, and Long-Term Cost Exposure 📈

Interest rates depend on credit profile, vehicle type, loan duration, and lender risk tolerance.

Shorter terms reduce total interest but raise monthly payments, while longer terms ease cash flow but increase overall cost.

Online tools allow borrowers to model these scenarios before signing. This modeling is essential to prevent negative equity and payment fatigue.

With car financing online, borrowers can visualize the full financial timeline instead of focusing only on the monthly number.

Loan Term Impact on Total Financial Commitment 📑

| Loan Length | Monthly Burden | Total Interest Risk |

| 36 months | High | Low |

| 48 months | Medium | Moderate |

| 60 months | Balanced | Higher |

| 72 months | Low | Highest |

Car Financing Online for New Cars Versus Used Vehicles 🚗

New vehicles often qualify for lower interest rates due to predictable depreciation and manufacturer backing.

Used vehicles may involve higher APRs but lower loan totals, which can offset interest differences.

Online financing allows buyers to compare both options objectively, without emotional influence from the showroom. This comparison clarifies which choice aligns with income reality and ownership horizon.

Using car financing online ensures the vehicle decision matches financial capacity rather than short-term desire.

Documents and Preparation for Online Auto Loan Approval 📂

Digital lenders streamline documentation but still require verification. Proof of income, identification, and residence remain standard requirements.

Submitting accurate documents early reduces delays and improves offer consistency. Organized applicants often receive faster approvals and more favorable terms.

Preparation strengthens results when applying for car financing online, especially in competitive lending environments.

Common Requirements for Online Financing Applications 🗂️

- Valid government identification

- Income or employment verification

- Proof of residence

- Vehicle information if already selected

Completeness minimizes lender follow-ups and speeds decisions.

How to Compare Lenders Effectively Using Car Financing Online 🏦

Not all lenders prioritize the same borrower profiles. Some emphasize low rates for strong credit, while others specialize in flexible approvals.

Online pre-qualification tools allow side-by-side comparison of APRs, fees, and early payoff conditions without immediate credit impact.

This comparison is the strongest advantage of car financing online, revealing true cost differences hidden in traditional financing.

Look beyond the sticker price and learn how technical specifications, powertrain efficiency, and equipment influence Toyota RAV4 Hybrid price.

Comparison of Digital Auto Financing Sources 🔎

| Source Type | Rate Stability | Flexibility | Speed |

| Banks | High | Medium | Medium |

| Credit Unions | Very High | High | Medium |

| Online Lenders | Variable | High | Fast |

| Manufacturer Finance | Promotional | Limited | Fast |

Understanding these distinctions prevents mismatched expectations.

Common Mistakes to Avoid With Car Financing Online ⚠️

Some applicants focus only on advertised rates without reviewing eligibility requirements. Others overlook origination fees or prepayment penalties hidden in contracts.

Failing to calculate total loan cost leads to long-term overpayment even when monthly installments appear affordable.

Responsible use of car financing online requires reading disclosures carefully and validating assumptions before acceptance.

Learn Why Online Pre-Approval Strengthens Vehicle Negotiation 💬

Entering a dealership with a pre-approved loan shifts power dynamics. The buyer controls financing, and negotiations focus solely on vehicle price.

This separation reduces upselling pressure and limits financing markups. Many buyers secure lower final prices by leveraging outside approvals.

Pre-approval through online financing converts uncertainty into leverage.

Calculate savings, compare lenders, and request your auto refinance quote right now. Discover how refinancing can immediately reduce costs.

Strategies to Improve Outcomes 🧠

Reviewing credit reports, reducing outstanding balances, and selecting realistic loan terms significantly improve approval conditions.

Submitting applications within a short time window minimizes credit impact while maximizing lender competition.

These practices ensure car financing online supports sustainable ownership instead of short-term access.

Why Digital Auto Financing Continues Expanding Nationwide 🌐

Consumer demand for speed, transparency, and autonomy drives digital financing growth. Online platforms meet these expectations while adapting to changing economic conditions.

As vehicle prices remain high, informed financing decisions become critical for long-term stability.

The structure of car financing online aligns with this reality, offering clarity when traditional methods fall short.

Build Financial Resilience Through Smarter Auto Financing 🧩

Auto loans influence budgets for years, not months. Structured financing with predictable payments protects future borrowing capacity.

Avoiding overextended terms and inflated rates preserves financial flexibility for emergencies or investments.

When applied responsibly, online financing becomes a financial planning tool rather than a liability.

A Smarter Ownership Path Starts With Financial Awareness 🚦

Vehicle ownership should reflect long-term financial health, not impulsive decisions. Online financing empowers buyers to pause, analyze, and choose deliberately.

By prioritizing transparency and preparation, consumers reduce stress and improve ownership satisfaction.

This disciplined approach transforms car financing online into a strategic advantage rather than a rushed necessity.

FAQ ❓

- Is online auto financing legally secure in the U.S.?

Yes, licensed lenders follow federal regulations and use encrypted systems to protect consumer data. - Does pre-qualification affect my credit score?

Most pre-qualification tools rely on soft checks that do not impact credit history. - Can dealerships reject outside financing?

Most dealerships accept external financing, though they may offer alternative terms for comparison. - Are online loan rates always better?

Not always, but online comparison increases the likelihood of finding competitive offers. - Is refinancing possible later?

Yes, many lenders allow refinancing if credit or market rates improve.